Credit hire firm Edam Group has ambitious plans to double its turnover in just three years, and believes fleet and customer service will be key to achieving that success.

The Manchester-based company has seen significant growth over the past few years – in 2015 the firm recorded a turnover of £35m, up from £27.5m in 2014, while last year the business grew again, to £50m. Although these are some impressive statistics, chief revenue officer Marc Lafferty told BusinessCar that the firm plans to double this figure to £100m by 2020.

“We’ve got less than 5% market share so there’s plenty of opportunities and we’ve set out our stall to very much be the market-leading service provider in this space,” said Lafferty. “We want to double the business over the next three years. The expectations around service levels and how we represent that through portals like Net Promoter Score and other surveys will be key, and we’re doing a lot of work to invest in our service delivery.

“I don’t think anyone is really setting out to be the number one service company in this sector and we are well on that journey. We’re doing a lot of things well and we’ve got really strong core values.” Most drivers would have come across a credit hire firm at some point if they’ve been involved in an accident because, in the simplest terms, credit hire companies provide the non-at-fault party after a road traffic accident with a replacement vehicle, reclaiming the cost from the other party’s insurance provider.

The company works with leasing companies, fleet management companies, insurers and brokers as well as dealers. Fleet is an area of development for Edam and a key benefit that Lafferty believes will be crucial for fleets is that the car is replaced like for like, unlike when you get a courtesy car from a bodyshop. “Fleets have high expectations, which is why we replace like-for-like, especially as fleets usually operate more premium vehicles,” Lafferty told BusinessCar. “It’s about the service they get. Quite often fleets and dealers want us to white-label our services and want it to look and feel like that service is delivered on their behalf, which is something we are used to doing.

“The critical thing for us is to get the driver mobile again, and we commit to do that within a few hours in a like-for-like vehicle. Depending on what agreement we have with our partners we may also organise a credit repair.” Two brothers, Daniel and Simon Bellamy, founded Edam Group in 2001 with just four vehicles on its fleet. Today, the firm has a fleet of 1,500 vehicles, all of which are outright purchased and most are under a year old.

“We’ve gone down the owned vehicle route for two reasons: one, it means our cars are never really older than a year, and the other thing is we need to match our fleet to our business clients’ requirements and need to adapt to be able to offer that service. We need to map and reflect what’s out there on the roads so we can effectively replace like-for-like.”

At a time when many companies are looking to branch out and offer a one-stop shop and a full range of services, Lafferty is very much focussed on credit hire for the foreseeable future. “All successful businesses I’ve been involved in the past are successful because they focus absolutely and resolutely on the things that they are good at, and we’re very clear that we want to position ourselves as the market-leading service provider, so therefore we are ruthless in investing in our people and our systems and we have very strong values in the business.”

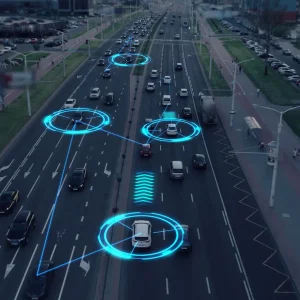

With the growing focus on autonomous technology, we asked Lafferty if Edam sees this as a potential challenge for their business and growth plans, which relies on accidents occurring to do business. “We’re dependent on a road traffic accident taking place so that we can deliver a service. There’s so much speculation around autonomous vehicles at the moment that it’s very hard to gauge when it’s going to happen,” said Lafferty. “There is definitely a perspective out there that there’ll be fewer accidents, but the severity will be higher. The other thing is that the existing car park has to be replaced.

“Even if you have all of the infrastructure in place, I genuinely think we are 15-20 years away before this has a significant impact on our business.”