Fleet often plays second fiddle next to the glitzier retail end of the industry, and nowhere is that more obvious than online. Load up a manufacturer’s site or scroll its social media feeds, and there is a splurge of content designed to reel in Joe Public. Fair play, retail sales are more profitable, but in the age of a new car market skewed vastly towards fleets and company car drivers, they deserve a little love and attention.

Once a year, every year, Business Car shines a light on the top 10 manufacturers’ fleet websites to reveal which ones genuinely consider B2B customers, and those with room for improvement.

As well as snooping around the sites, we adopt the role of online mystery shopper, and try out each brand’s digital customer services to assess how well it handles basic product enquiries. This year, there was a noticeable decline in the live chat and social media responses, so much so that we gave three manufacturers 0/10 for the latter, because they either refused to answer our question or got the answer completely wrong.

This is not a post-pandemic malaise thing, either. Standards genuinely were much better when we put these services to the test in 2023, and some AI facilities have yet to live up to the hype.

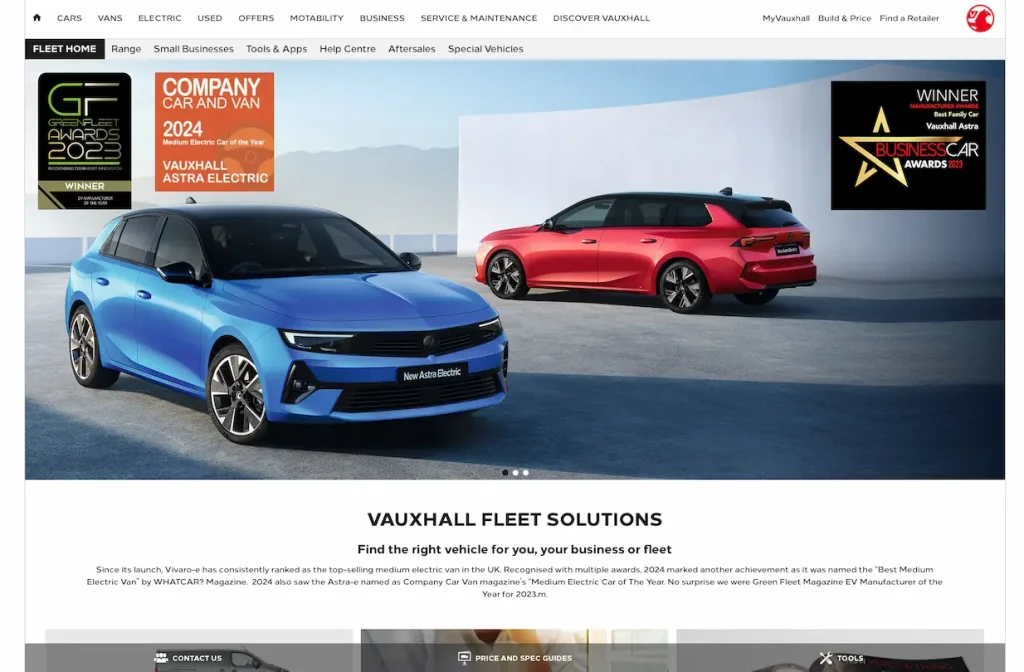

Vauxhall topped our assessment for the second consecutive year, which was no great shock. It pays close attention to this feature and its consistent excellence is in no small part down to its acknowledgement of our comments and criticisms. Crucially, it acts on them, so all credit to it for adding seven points to its lead and trumping its closest competitor by a hefty 12%.

Only three points separated second and fourth places. Nissan was this year’s big surprise, as it bumped along the bottom of this analysis for years, but a fresh design in 2023, plus bucking 2024’s trend for naff live chat and messaging responses, propelled it to second.

Often a strong performer, Toyota’s superbly fleet-friendly site muscled its way to third after a dip to fifth in 2023, while Hyundai’s changed for better and worse, but its overall performance was consistent (its year-on-year percentage score was identical), leaving it a comfortable fourth.

As lovely as Mercedes’ website looks, it was dogged by this year’s archetypal messaging issues, which relegated it to fifth after a one-two in 2022 and 2023. Kia’s simple but effective site rose one place to sixth, while Volkswagen’s updated extras (there is apparently a fresh fleet section in the offing later this year) bumped it two places to seventh.

Ford’s site is showing its age, which is why it jointly began the bottom three with BMW, which really fell from grace. It dropped six places due to its strange and evasive direct message response (it was great last year) and is another one that desperately needs refreshing.

As in 2023, Audi rounded off the bottom 10. Its live chat response was actually the best of the bunch, but it got the answer wrong when we messaged it on X, and many areas of the site are vastly bettered by rivals.

| Ranking/position change from 2023 | Manufacturer | Score | Good | Bad |

| 1 (no change) | Vauxhall | 75% | The best all-rounder by far with an exceptional focus on fleets | Others have snazzier configurators; room for improvement with live chat |

| 2 (+6) (most improved) | Nissan | 63% | Top-notch live chat and social media messaging | Lacklustre social media and brochures |

| 3 (+2) | Toyota | 61% | Excellent access to key fleet info; strong brochures, dealer finder, and extras | Poor live chat and uninspiring social media |

| 4 (no change) | Hyundai | 60% | Rapid messaging response and improved mobile site | Used to have good calculators, but they have disappeared |

| 5 (-3) | Mercedes-Benz | 55% | Aesthetically, it is the best website; exquisite brochures and configurator | Live chat and messaging leave much to be desired |

| 6 (+1) | Kia | 53% | Really easy to use; good configurator and dealer finder | Mobile site and brochures need work |

| 7 (+2) | Volkswagen | 51% | Dealer finder and fresh extras among the best | No brochures; key info takes some unearthing |

| =8 (-2) | Ford | 44% | Best dealer finder and fleet-focused social media | Lots of factors are below par and it could do with a refresh |

| =8 (-6) (biggest faller) | BMW | 44% | Excellent configurator and very good live chat | Bizarre messaging response; design really needs updating |

| 10 (no change) | Audi | 35% | Best live chat and well-designed mobile site | No brochures; answer to our social media message was wrong; generally below average |

How our analysis works

In late June and early July, we studied the top 10 OEMs’ (according to 2023 SMMT full-year registrations) websites. We punch the name of brand and ‘fleet’ into Google, to arrive at what should be the main page for business car operators. That is our starting point, and we navigate to other pages from there.

We examine 10 key areas, each of which receives a score from one to 10, or zero when services are absent, or the answer was wrong. We like sites that cater well for fleets and company car drivers and provide genuinely useful information and resources, as opposed to just trumpeting the products. When we engage with OEMs online, we

look for speed, relevance, clarity, and politeness. We also ask each brand’s press office if the fleet pages have been updated since our last assessment.

Ease of use: A good website should make key information about the company’s products clear and visible. Our barometer? Start at the fleet homepage and count the number of clicks it takes to find the price of a popular model (even better if it is a P11D), followed by CO2 and BIK.

Design: Aesthetics count in the fickle online world. A good-looking site encourages users to stay put, and vice versa.

Configurator: The user-chooser’s go-to tool. The best are joys to behold, present their information clearly, and load up in a heartbeat.

Brochure download: If you think brochures are yesterday’s news, look at our pick of the best. They are incredibly useful one-stop-shop sources of information – but some OEMs have ditched them.

Live chat: We opened up each manufacturer’s live chat service and asked if a popular model was fitted with autonomous emergency braking (AEB) as standard (every car was – we checked). Responses were judged on speed, accuracy, and politeness.

Social media: Pure self-promotion does not wash with us. We want to see pages and/or posts with content relevant to fleets.

Social media messaging: Same as live chat – we sent each OEM a direct message on Twitter/X (or tried to) and ranked the responses using the same metrics.

Dealer finder: Every site has one. The best are easy to locate from the fleet homepage and include relevant filters.

Mobile site: A coherent and uncompromised conversion to a mobile format is a must today.

Extras: We rate the OEMs that go the extra mile by adding useful tools, guides, and other content to their fleet pages.

Cold call: Putting OEM phone services to the test

We removed phone calls from the scored assessment last year, but still believe they are worth assessing, because a large company with a public-facing number really should be able to answer a basic question about one of its products. It is worth mentioning that BMW, Ford, Kia, Vauxhall, and VW have dedicated fleet phone numbers, which should (you would hope) better serve our readers, but we deliberately rang the generic customer service number because nine of the top 10 manufacturers publish one on their sites, while only five have a fleet hotline.

As with our live chat and social media messages, we asked each OEM if a popular model was fitted with autonomous emergency braking as standard (spoiler: they all are).

First, the bad. We could not get through to Kia, Vauxhall cut us off after five minutes on hold, Mercedes put us through to a dealer and we were disconnected after the third transfer, and Toyota does not have a public-facing phone number (that said, there are other ways to get in touch, so better no service than a poor one). The initial automated response from VW and Audi’s call centre offers to text you a link to vehicle specs, which is a good start. We still asked to speak to an operator, and VW’s was polite but confused. They kept us on hold for five minutes while they searched for an answer, then got it wrong. Audi was similar; the call took 12 minutes and the agent was obliging, but could not find the answer and offered to email us later.

Nissan, which nailed live chat and messaging, also blew rivals out of the water on the phone, because we had a clear answer in five minutes. Hyundai was not far behind, delivering the same in less than nine.

Ford put us through to a dealer and we had to answer a lot of questions but, in just over nine minutes, we had an answer from a sales executive. Given its previous standard-issue response of ‘don’t ask us, call a dealer,’ that is better than it has ever done, even if it was a dealer that answered the question.

Finally, BMW took more than 13 minutes, but that is because its agent took the time to find us a very comprehensive correct answer.